Maritime Mutual’s range of insurance products for ship owners and charterers provide comprehensive cover for both liability exposures and hull damage.

MARITIME MUTUAL’S SECURITY, CAPACITY, FLEXIBILITY AND RELIABILITY

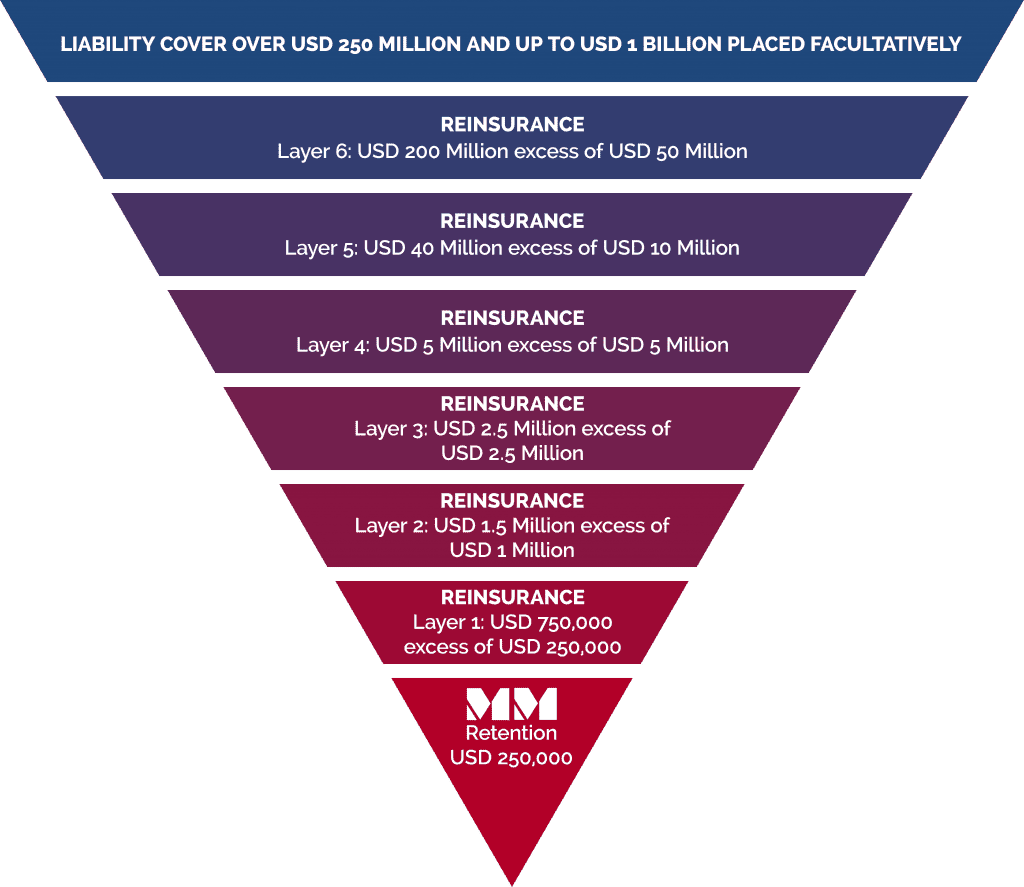

Maritime Mutual’s insurance cover is provided through the process of mutuality and the premiums paid by its Members. To further protect its Members, the Club’s retained exposure is limited to the first USD 250,000 of any claim. Claims in excess of this amount are reinsured through a high quality programme created by renowned London market reinsurance brokers. Maritime Mutual’s retained exposure and its layered reinsurance programme, up to USD 1 Billion, is illustrated in the diagram below.

Click image for larger view

The majority of Maritime Mutual’s long term reinsurance is provided by Lloyd’s Syndicates (Standard & Poor security rating A+ and AM Best rating A). the balance is provided by established company market reinsurers Hannover Ruck SE (Standard & Poor rating AA- and AM Best rating A+) and GIC India (AM Best rating A-). Maritime Mutual’s own security rating, assessed by US based ratings agency Equifax is BBB+.

In terms of capacity, Maritime Mutual can provide up to USD 1 Billion in liability cover to its Members if required. As for flexibility, there are no restrictions on vessel types, trades (apart from voyages to the USA) or age and Maritime Mutual will offer insurance terms based on observed vessel condition.

Maritime Mutual’s reliability is demonstrated by its claims settlement record which totals USD 22.5 million paid out to its Members since its establishment in 2001. This affirmative record, together with Maritime Mutual’s high level of security, has resulted in the global recognition of Maritime Mutual’s ‘Blue Cards’ and MLC certificates for both flag state and port state compliance purposes.

Claims Handling

Damage and liability incidents cause voyage delays, customer dissatisfaction and loss of profits. Maritime Mutual’s mission is to protect their Members from business disruptions by responding quickly and pro-actively to reported incidents.

Security Rating

BBB+

Investment Grade

Maritime Mutual’s financial security is rated BBB + and ranked ‘Investment Grade’ with ‘Low Risk’ by Equifax Australasia.