Introduction

Shipowners will be aware that the International Maritime Organisation’s (IMO)2020 Global Sulphur CapSulphur Cap will come into force on 1 January 2020. As provided by MARPOL, Annex VI, the sulphur content in fuel oil used on board all ships must then not exceed 0.5% m/m (mass by mass). Similar 0.5% sulphur restrictions have already been imposed by China in the Yangtze River Delta Emission Control Area (ECA) and will be imposed in the Bohai-Sea and the Pearl River Delta ECA’s as well as in Hong Kong waters on 1 January 2019. China and Hong Kong will, therefore, be one full year ahead on actioning the IMO’s 2020 provisions.

Background

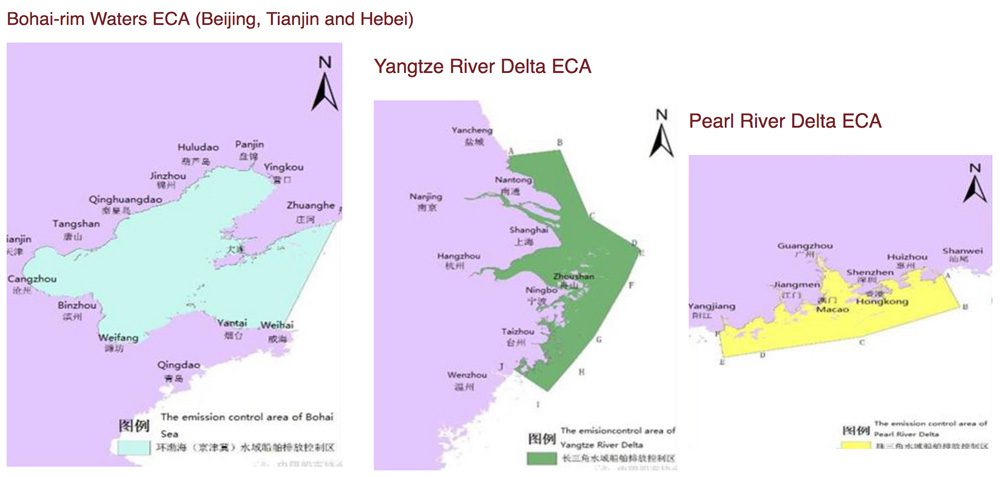

China’s Marine Safety Administration (MSA) provided the ship exhaust reduction lead in Asia by setting up three nationally legislated Emission Control Area’s (ECA’s) in 2015. These areas, shown in the map extract and as noted above, were the Bohai-Sea ECA, the Yangzte River Delta ECA and the Pearl River Delta ECA.

China’s MSA introduced their ECA 0.5% sulphur content restriction obligation by a gradual process of first implementing it at major ports within the designated ECA’s from April 2016 onwards. More and more ports within China’s ECA’s were then added as the MSA gained more experience in ship fuel and exhaust inspection. Later, the imposition of the 0.5% sulphur regulations was widened to include the entirety of the ECA areas which extend up to 12 n.mi. offshore.

Shipowners who trade into China and the three ECA areas will be aware that since 1 January 2018, ships have been required to burn fuel with a sulphur content not exceeding 0.5% while berthed alongside at all ECA ports (except for one hour after berthing and one hour before departure).

What has changed already and will change further in China’s ECA’s?

The prohibition against burning fuel containing more than 0.5% sulphur was extended on 1 October 2018 to now include the burning of such fuel not only while berthed alongside but also from the time a ship enters the Yangtze River Delta ECA (extending 12 n.mi. offshore) until she exits. In summary, throughout the entire duration of a ship’s navigation and stay within that ECA.

As of 1 January 2019, and in accordance with originally notified timelines, the same extension of the 0.5% sulphur restriction will apply inside both the Circum-Bohai-Sea and the Pearl River Delta ECA’s.

What will soon change in Hong Kong waters?

The prohibition on burning fuel with more than 0.5% sulphur content while berthed alongside has been in force in Hong Kong since August 2015 under the ‘Fuel at Berth Regulation’. The Environmental Protection Department (EPD) has recently announced that this regulation will be superseded by a new ‘Fuel for Vessels Regulation’ which from 1 January 2019 will require the use of compliant fuel inside Hong Kong territorial waters, irrespective of whether they are navigating or berthed alongside.

Regulatory obligations and penalties

Under Hong Kong’s new Fuel for Vessel’s Regulation, ocean-going vessels using heavy fuel oil (with a reported average sulphur content of 2.6%) must switch to compliant 0.5% sulphur fuel before entering Hong Kong waters. Written procedures for the fuel switch must be available on board. The times of entering and exiting Hong Kong waters and the particulars of the fuel switch operations must be recorded in the ship’s log books. The log books and all bunker delivery notes must be kept on board for a period of three years.

When the Fuel for Vessels Regulation comes into effect, the master and owner of any vessel using non-compliant fuel within the waters of Hong Kong will be liable to a fine of up to HKD 200,000 (USD 25,000) and/or imprisonment for six months. Masters and shipowners who fail to record and keep the aforementioned records and particulars will, in addition, be liable to a fine of up to HKD 50,000 and/or imprisonment for three months.

Under China’s current regulation and law, Art. 106 of The Law of Prevention of Air Pollution Art 106 provides that where the ship does not use the prescribed fuel, the MSA may impose a fine in the amount of RMB 10,000 to RMB 100,000 (USD 14,000). The Regulation of Prevention and Control of Marine Pollution to the Marine Environment Art. 28 provides that a ship must keep bunker delivery documents on board for three years and fuel samples for one year. If a ship fails to do so, then a fine in the amount of RMB 2,000 to RMB 10,000 may be imposed.

Enforcement

The 0.5% sulphur limit prescribed by the IMO’s MARPOL Annex VI for 2020 is essentially the same as that prescribed by China’s ECA and Hong Kong waters regulations that have been enforced since 2016 against vessels berthed alongside.

As such, both China’s and Hong Kong’s maritime agencies and their PSC operatives have the skills and experience to detect breaches of the current and soon to be upgraded 0.5% sulphur fuel use requirements in both China’s ECA’s and Hong Kong waters. Numerous fines are reported to have been levied and ships have been detained pending both payment and rectification of observed non-conformities. Delay losses caused by charter off hire and missed fixtures can be even more costly.

Conclusion and Takeaway

There are a number of loss prevention issues that must be actioned to ensure compliance with both existing and upcoming 0.5% sulphur content regulation in both China’s ECA’s and Hong Kong waters. MM’s loss prevention recommendations for its members include but are not limited to the following:

- Ensure the awareness and understanding of the relevant regulation by technical and commercial ship managers as well as all Masters and crews trading to China (PRC) and Hong Kong ports.

- Prepare and include specific ISM Code procedures into shore-based and shipboard SSM manuals which cover the relevant 0.5% fuel requirements.

- Consider the necessity to engage independent bunker fuel analysts to ensure the accuracy of the sulphur content declaration by suppliers and charterers.

- Confirm implementation during internal ISM Code audits conducted by appointed DPA’s and superintendents inclusive of:

- Meeting with the Master, Chief Engineer and all ship’s officers to assess their understanding of the relevant regulations including log book entries and retention of both fuel receipts, analysis documents and samples.

- Checking both deck and engine log entries relating to the time and position when entering into exiting from Chinese ECA’s and Hong Kong waters.

- Reviewing the fuel change over procedures with the engine manufacturers to ensure that the intended procedure will not damage the engine systems.

- Confirming the posting on board of the agreed fuel change over procedures.

- Ensuring the proper training of the engine room crew in using those procedures.

- Witnessing a satisfactory fuel change over procedure drill conducted by the engine room crew.

- Verifying that fuel receipts, analysis documents and samples are properly filed, stored and available on board for inspection by PSC.

- Making sure that there is adequate tank storage available on board to separate fuel types and avoid cross-contamination.

MM’s recommendations may appear to be a lengthy list which only applies to MM members who are trading into Chinese ECA areas and Hong Kong waters. And perhaps you do not currently trade to these areas? However, please remember that when the MARPOL 2020 Global Sulphur Limit comes into full force on 1 January 2020, MM’s compliance recommendations for entry into China’s ECA’s and Hong Kong waters will effectively extend to all ships, anywhere in the world.